Denial isn't just a river in Egypt: Gl. 6, premium hikes and policy rejections

16% of AS patients surveyed say they have had an insurance problem

“There are worse things in life than death. Have you ever spent an evening with an insurance salesman?” —Woody Allen.

By Howard Wolinsky

In early 2003, at age 55, I purchased a 10-year term-life insurance policy as a supplement to whole-life policies. I accepted a preferred rate of about $2,000 per year for $600,000 in coverage.

In 2013, I considered renewing with Transamerica.

They agreed to cover me again with a $600,000 policy. But things changed, They wanted about $10,000/per year without my going through medical underwriting.

It was too rich for my blood.

So my agent Steve Persky, a boyhood friend, went shopping for alternatives.

Underwriting was a problem for me. Within years of the policy going into effect, I had had a near-fatal heart attack (known as a widowmaker) in 2005 and was diagnosed with low-risk Gleason 6 prostate cancer in late 2010.

Under a microscope, my tiny one-millimeter speck of Gleason 6—seen only once in more than 80 cores over the years—looked like cancer to the eyes of a pathologist but didn’t behave like cancer based on the experience of a urologist.

My urological oncologist then, Scott Eggener, MD, assured me would the cancer would never spread and would never kill.

But insurance companies only saw a bad risk, mainly because I had a cancer that I chose to leave untreated.

At least eight insurers declined to sell me coverage for term life insurance, which pays a benefit in the event of death during a specified term.

Steve wrote an email to me:

“Howard, Just so you see, this is the data we share with probably 8 companies and you see the type of answer we have gotten as well. So far, we do not have any positive response. I just wanted to share this with you.”

That was bad news, and I worried about how to provide additional protection for my wife and sons should I die.

My money and, apparently, my underwriting information were not good enough for the likes of Transamerica, my original insurer, as well as United of Omaha, and Lincoln National, and others.

Would that have depressed Woody Allen?

(An insurance company memo declining coverage.)

Eggener went to bat for me.

On Jan. 19, 2013, he wrote:

“You have very low volume Gleason 6 prostate cancer.

Active surveillance for your type of cancer is not associated with an increased risk of mortality compared to the population of men without prostate cancer.

“It is disappointing they won't insure you, but I am not surprised one bit. To the non-medical community, cancer is cancer is cancer. It is really a shame they don't appreciate that.

SCOTT EGGENER, MD

Associate Prof of Surgery - Urologic Oncology

The University of Chicago Medicine & Biological Sciences

Still, insurers stood by their decision not to insure me.

My broker came back with another offer from Transamerica for a universal life policy, a flexible life insurance policy with a cash value.

I didn’t dare refuse.

We carved out a portion of my original $500,000 term policy and placed a $100,000 bet until age 85 on universal life—a type of permanent insurance. I kept the same monthly premium of $184 but with a dramatic 80% decline in coverage from $500,000 to $100,000.

It was better than nothing. I still have the policy along with a couple of paid-off whole-life policies.

Insurance underwriters operate in strange and mysterious ways.

I had a near-fatal heart attack —known as a “widowmaker” or STEMI—at age 57 in 2005. I survived it because I had exercised regularly for more than 30 years and developed collateral blood flow that saved me from a fluke 98% blockage of the main artery, the left anterior descending artery. I had a couple of stents implanted, and life went on.

It’s hard to believe, but true: The underwriters didn’t mention that widowmaker that obliterates most people. I should have died on Valentine’s Day 2005.

But the underwriters pounced on a tiny speck of Gleason 6 ”cancer” and denied me coverage. My urologists refer to this cancer as “wimpy” and “lame.” Underwriters considered this cancer an existential threat.

In December 2021, I filed a belated complaint about insurance discrimination with the Illinois Department of Insurance (DOI) just to see what would happen,

I realize now my gripe should not have been with Transamerica over my renewal but with seven other companies that declined me coverage based on my Gleason 6 diagnosis.

I told the Illinois Department of Insurance that I was the victim of predatory and discriminatory practices because I had Gleason 6 cancer. I urged DOI to investigate this discrimination against men with so-called Gleason 3+3 “‘cancer’ as demonstrated in my case.”

They dismissed my complaint against Transamerica. But didn’t pick up the scent of discrimination from the other companies.

***

More than 90,000 American men a year are diagnosed with Gleason 3+3= 6 and 60% now choose to leave it untreated because, as Dr. Laurence Klotz, of the University of Toronto, who developed the active surveillance strategy more than 30 years ago, said, Gleason 6 NEVER metastasizes and NEVER kills. The numbers of those opting for AS were smaller in 2013, about 30%.

From a patient’s viewpoint, the insurance companies seemed oblivious at worst and uncomprehending at best—though underwriters no doubt were tuned in on these life-and-death issues.

***

Let’s hear the insurance industry viewpoint.

Fourteen-year AS veteran and insurance broker/underwriter James Goodacre 74, of Carmel, California, said his industry considers Active Surveillance a recent development that only became available in the last 30 years.

“During the first 10 years of active surveillance, my guess is the insurance companies didn't feel comfortable about the idea that the client was doing nothing about their prostate cancer,” he said.

“The insurance companies probably thought: Great, the prostate cancer is just going to continue to grow until it gets worse, and then something has to be done about it. Again, remember there is nothing that says you have to have a PSA every 3 months and an ultrasound every six months, and a biopsy or MRI every 1-2 years.

“Who is going to chase the person around and make sure they stay up with what they are supposed to do to keep an eye on it? Because when that policy gets issued, that insurance company can't say five years later, we want to rescind our offer on your policy because we hear you haven't been keeping up with the standard guidelines for Active Surveillance. Tough luck for the insurance company that the client doesn't follow through with the Active Surveillance and the client dies.

“Who makes a bad decision? It is the underwriter for trusting that the client would follow the guidelines of Active Surveillance. So, that is why some insurance companies will decline the person for insurance because they just don't want to take the risk. And other insurance companies will say OK, but we want some extra premiums just in case you don't follow the guidelines, or your prostate cancer gets aggressive in the future as we have seen in more than one case.”

What happened with my insurance? Why was I offered universal life but rejected for cheaper a cheaper term life policy with higher coverage,

Goodacre said, “It is simple. They are willing to take the risk on you but only for $100,000 and with a higher premium and not $500,000 because when you took out the policy [10 years earlier], you were not on Active Surveillance, but now you are, and they don't know what your future will look like 10 years from now.

“Actually, you are lucky your broker found you a $100,000 of life insurance. Also, you could have kept the $500,000 of coverage but you would have had to convert it to a universal life policy or a whole life policy. But the minute you heard what the premium was you would have probably said how much is a universal life or whole life policy for a smaller amount.”

Goodacre explained the underwriting guidelines that an underwriter looks at when an application for life insurance comes to their desk:

Assume the applicant is on Active Surveillance between the age of 70-90 and has a PSA of under 10. The applicant also has to have a Gleason 6 or less without a rising PSA.

Goodacre said; “That underwriter is going to offer anywhere between a standard rate and (not a Preferred Rate) up to 200% above the normal rate. An applicant applying for coverage who is aged 60-64 will be offered normally a Table B rate, and an applicant 65-70 will be offered a rate above the Table B rate. Who knows maybe a table C or D rate or higher.

“The higher the letter the higher the extra premium above the normal rate. Also, what you have to understand is that the underwriter is looking not at just your prostate cancer only but also looking at your overall health. T

“That is why in most cases you need to take a physical to have the policy get issued. They want to know your blood pressure, height, and weight, what your cholesterol readings is, or when your last colonoscopy was, and the list goes on and on. They then send off for your medical records from your attending physician, who has medical history on you that may go back to childhood. There are a lot of factors that go into what the underwriter will ultimately offer to the applicant.”

“As an underwriter, you have to look not at just what his prostate cancer is doing, but you have to make a decision on anything in the person's past that could have a bearing on issuing the policy and, if the policy, can be issued then at what rate.”

Whew. Back to my consumer view …

This is the Rashomon effect in action. My view, My broker’s view. The insurers’ view. Jim Goodacre’s view as a broker and underwriter. And finally, the stare’s view.

I told the Illinois Department of Insurance that some—not all—men with this low-risk diagnosis face discriminatory rates and outright coverage denials for life insurance and jacked-up premiums.

Meanwhile, years have passed, and because of this injustice and much worse I have witnessed, including too many men being treated with prostatectomies and radiation and their horrible side effects, I became an advocate for fellow patients with low-risk prostate cancer. I did this by co-founding Active Surveillance Patients International and AnCan Foundation’s Virtual Support Group for Active Surveillance, working with other groups, as well as starting TheActiveSurveillor.com newsletter.

A paper to redefine Gleason 6 as a noncancer

Eggener last year asked me to join him and fellow researchers as a patient rep on a paper they were preparing about why Gleason 6 should be re-labeled as a noncancer. This revives a 10-year-old debate within the academic world between urologists and pathologists,

I won’t get into the histological, morphological, genomic, or other technical issues.

My arguments covered very human issues: emotional distress and stigma relating to being tagged as “a cancer patient” and also financial toxicity, such as job and insurance issues springing from being told you have cancer, even a “wimpy one” like mine.

Our paper, “Low-Grade Prostate Cancer: Time to Stop Calling It Cancer” caused a major stir. It was the most-mentioned paper in the Journal of Clinical Oncology in 2022.

Public TV, Associated Press, Fox News, NBC News, the LA Times, Chicago Tribune and more picked up on what had been an academic debate now gone public.

Jonathan Epstein, MD, a world-renowned uropathologist at Johns Hopkins, and Adam Kibel, MD, urology chief at Harvard, answered in a paper “Renaming Gleason Score 6 Prostate to Noncancer: A Flawed Idea Scientifically and for Patient Care.”

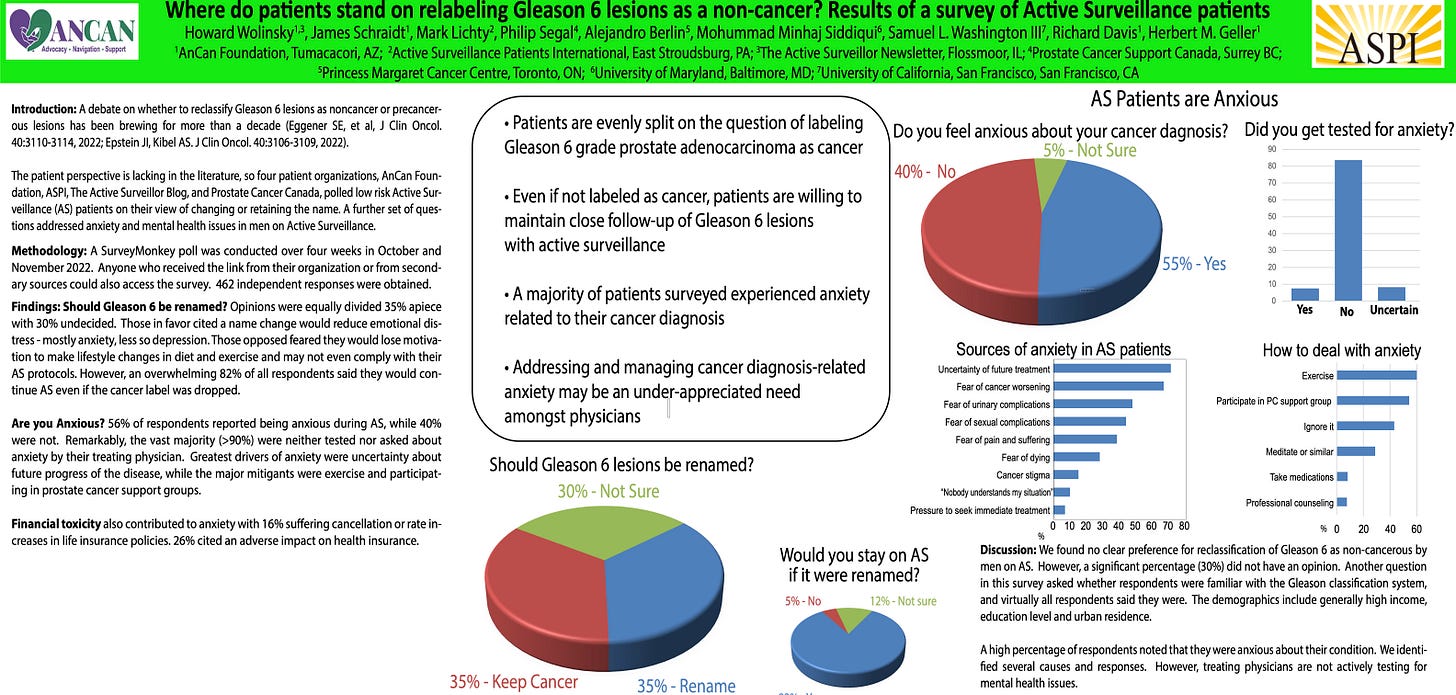

Then, I was involved with other patients and top docs in a survey of patients on these issues presented as a poster at the American Society for Clinical Oncology Genitourinary Cancers Symposium in San Francisco.

I covered the high points in TheActiveSurveillor.com with comments from the gurus and in a more personal view in my blog in MedPageToday.

I also presented the patient side at a closed-door session of experts at UCSF in a program called “CAncer or Not Cancer: Evaluating and Reconsidering GG1 prostate cancer (CANCER-GG1?),” citing the poster.

I only here want to highlight one finding: 16% of more than 450 AS patients who responded said they experienced insurance discrimination. Most, like me, had rate hikes or policy denials for term life insurance.

I told the session of top experts, including top prostate doctors, and the CEOs of the American Cancer Society and the Prostate Cancer Foundation, that this topic ought to be probed in greater depth.

We also need to explore job discrimination. Is it real? How are men in real careers impacted by pseudo-cancers?

I know that many men do not inform their employers about Gleason 6 for fear that their careers will be blocked. Others fear they will lose clients who might think their Gleason 6 “cancer” diagnosis would interfere with their ability to deliver the goods on the job.

Underwriter Goodacre said his field has been evolving from the time when prostate cancer was diagnosed and men inevitably faced surgery or radiation:

“It takes time for that to filter down to the underwriters of insurance companies. We are now seeing today underwriters who have a better understanding of Active Surveillance and are willing to go out on a limb and take that risk that it isn't a life-threatening condition if you have a Gleason 6 score,” he said.

If you have tales about your experience with insurance discrimination—rejected policies or outlandish rate hikes—because of Gleason 6 “cancer,” please share them in the comments above or write to me directly at howard.wolinsky@gmail.com.

(Part II: More thoughts about Gleason 6 and insurance from an underwriter on AS. More below.)

ASPI needs recos for awards

By Howard Wolinsky

Active Surveillance Patients International, founded in 2017 as the first international support and education group dedicated to Active Surveillance (AS), has announced an expanded awards program to recognize patients, doctors, and programs that have advanced the cause of AS - close monitoring of prostate cancer.

ASPI is soliciting your nominations from the AS community and beyond for the awards.

ASPI will present two new awards in 2023:

--The ASPI AS Advocacy Award. This award goes to a layperson who has made a significant contribution toward the advance of AS.

--ASPI AS Special Award. This award will go to a group of doctors or patients who have made a special contribution to AS.

Please send any nominations to The ASPI Awards Committee at mlichty@aspatients.org ASAP.

ASPI is continuing the Dr. Gerald Chodak Active Surveillance Pioneer Award for medical professionals who advanced the cause of AS. This is the second year ASPI will present this award.

Laurence Klotz, MD, the so-called “father of AS,” credited with naming the management technique, was the first recipient of the Chodak Award last year.

Klotz is a urology professor at the University of Toronto and Chief, Division of Urology, Sunnybrook Health Sciences Center.

Chodak, a urology professor at the University of Chicago Pritzker School of Medicine, provided the seminal thinking for the AS approach. He created the Us TOO support organization, which merged in 2021 with ZERO, and was ASPI’s first medical adviser.

Chodak died in 2019 from an aneurysm at age 72. (His obit: https://www.medpagetoday.com/special-reports/apatientsjourney/82547)

Among his many avocations, including tango and golf, Chodak was a glassblower.

Robin Chodak, Gerry’s widow, endorsed the awards program and donated a piece of her late husband’s art, a decorative glass bowl emphasizing blue, the designated color for prostate cancer.

(Dr. Klotz spoke about Dr. Chodak and the future of AS at the 2022 Awards virtual ceremony.)

Klotz received the bowl in honor of Chodak and the award.

(Note Dr. Klotz and the bowl that Dr. Chodak made.)

The awards committee includes: Robin Chodak, Dr. Chodak’s widow, a grief coach and author; Mark Lichty, co-founder and chair of ASPI; Howard Wolinsky, ASPI co-founder and editor of TheActiveSurveillor.com newsletter; Paul Schellhammer, MD, an advanced prostate cancer survivor and past president of the American Urological Association; Ericka Johnson, PhD, a social scientist at Linköping University, Sweden, and author of “A Cultural Biography of the Prostate”; James Schraidt, a patient advocate, former chairman of Us TOO and now a board member for ZERO: The End of Prostate Cancer.

Our previous poll results:

Health insurance and pre-existing conditions

By Howard Wolinsky

Some respondents to our survey of 450 men said that because of their Gleason 6 diagnosis their health insurance company moved them into higher-risk groups.

This would appear to violate U.S. law since 2014 under Obamacare.

I can’t explain this. But that’s what these respondents said. Maybe their experiences predated the ban on pre-existing conditions.

James Goodacre, an active surveillance patient and an insurance broker from Carmel, California, said of the claim of health insurance discrimination: “That statement is not correct in the United States since January 2014 President Obama mandated that everyone in America must have a health insurance policy or pay a penalty of 2.5% of your Income in a form of a penalty that must be paid when you do your taxes each year. So, for anyone to say they have a problem getting insurance is just not true.

“All insurance companies since January 2014 must by law issue a health insurance policy to anyone who asks for a policy to be issued. We, as insurance agents, and insurance companies, can't ask any health history questions so everyone will qualify for coverage and all pre-existing conditions are covered under the policy. So, please stop saying that you have heard that people are having problems getting insurance issued to them.”

The U.S. Department of Health and Human Services says: “Health insurance companies cannot refuse coverage or charge you more just because you have a ‘pre-existing condition’ — that is, a health problem you had before the date that new health coverage starts.”

HHS said: “Health insurers can no longer charge more or deny coverage to you or your child because of a pre-existing health condition like asthma, diabetes, or cancer, as well as pregnancy. They cannot limit benefits for that condition either. Once you have insurance, they can't refuse to cover treatment for your pre-existing condition.”

Still, disability insurance and long-term care insurance also have been affected.

Canadians have access to universal health care. But a Canadian doctor told me in an article entitled “Some insurance companies are open to covering men with low-risk prostate cancer,” that he has seen discrimination in travel insurance for Canadian men with Gleason 6.

Thanks for sharing, Tom. Again, I feel your pain. Howard

I found some old insurance records and updated this story. My term life insurance company was greedy.--from my POV. After 10 years, they suggested raising my premium fivefold to $10k/year. They say my Gleason 6 diagnosis wasn't the reason. However, it is clear that eight companies rejected my applications for new term policies because I was on AS. They wouldn't consider me for insurance unless I underwent radiation or surgical treatments.